Xero (ASX:XRO) FY24 in review

Scaling New Heights Sustainably with Room to Grow

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in stocks mentioned and hence probably biased. This website and article isn’t writtent to give you advise. I am just using as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t relie on it. Please conduct your own research or consult a prefessinal financial advisor - I am not the one.

When I last delved deeply into Xero, I outlined five key areas to watch. These questions will likely find their answers over time, particularly as the current CEO has laid out a strategy for FY25 to FY27. We can start evaluating her execution of this strategy from FY25 onward.

U.S. Market Focus: Will the management’s renewed investment focus on the U.S. market lead to a sustainable increase in market share?

Competition Challenges: How will formidable competitors, like Intuit in the U.S. and Sage in the UK, affect Xero's position and growth trajectory?

Market Saturation in ANZ: Is there still growth potential in the ANZ market, or is Xero approaching saturation there?

Diversification of Revenue: How quickly can Xero diversify its revenue streams? Does it have the capability to branch into adjacent markets as successfully as it has in its core accounting sector?

Streamlining Costs: To what extent can management reduce operating costs, especially in Sales and Marketing, without slowing the company’s growth momentum?

However, one thing is clear—the execution so far has matched the promises made. It was projected that operating expenses would decrease as a percentage of revenue, and they indeed fell to 73.3%, marking the first check in the box.

Another significant point is the CEO’s aspiration target of achieving the Rule of 40—the sum of revenue growth percentage plus free cash flow margin percentage—which was met in FY24. Although Sukhinder Cassidy has reiterated that the Rule of 40 is not guidance but an aspiration, and they are prepared to adjust it if opportunities for investment arise. She also hinted that the business could potentially double while maintaining the Rule of 40, though these were not her exact words.

When Sukhinder Cassidy took on the CEO role, she inherited a series of challenging acquisitions and poor investor sentiment. In just over a year, she has turned this around by shedding non-core, unprofitable parts of the business and refocusing with a clearly defined three-year strategy.

Simply put, a business needs a solid strategy and effective execution to yield good results. The strategy presented by Sukhinder Cassidy at Xero’s Investor Day appears sound and logical from an external viewpoint. And the results so far have been impeccable, which significantly bolsters trust that execution will be great and that probably has improved investors sentiments.

Xero's revenue growth primarily comes from increasing the number of subscribers and enhancing ARPU (either through price increases or by adding extra services for existing customers).

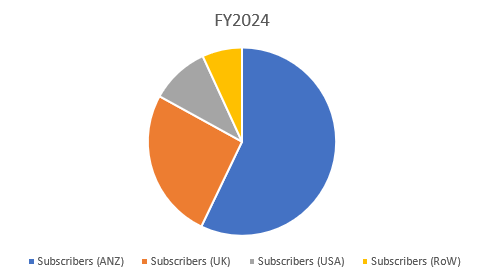

Following chart looks at the Xero’s dependancy in ANZ region as of FY24

Subscriber growth chart as below:

ARPU over the time

As a result of Subscirber and ARPU growth, Revenue is just the end result as shown in graph below

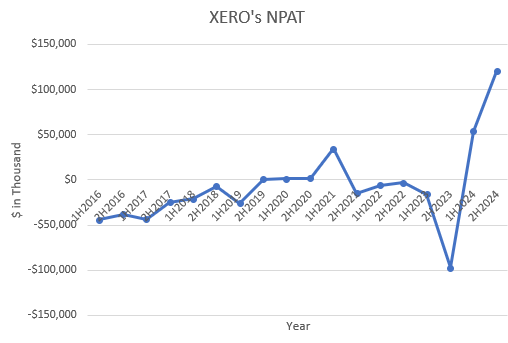

Since joining, Sukhinder Cassidy has pushed a strategy focused on cutting operating expenses and growing sustainably, which has significantly improved Net Profit After Tax (NPAT).

From the data, it’s evident that pricing strategies have driven ARPU growth, substantially contributing to Xero’s revenue increase. So far, churn rates haven't risen, and there are still opportunities for further growth from ARPU through upcoming price increases or package simplifications. However, Xero cannot rely solely on raising prices indefinitely; hence, growth in subscriber numbers or additional service uptake will need to play a larger role in the future. For subscriber growth, international markets need to contribute more compared to ANZ, where Xero already holds a dominant position. While the ANZ market doesn’t seem saturated yet, growth in international markets must justify the current valuation. The results were promising, and the CEO has instilled confidence by proving her commitment to her plans. I’ll be looking forward to the 1H FY25 results to analyze further trends

Hi GG, Absolutely love your work! Thank you for all the content you've provided, really valuable stuff. I had a quick question, I remember reading somewhere on your XRO commentary about UK Tax laws? How an adoption of a UK tax law might be beneficial for XRO? Cannot seem to find it anywhere.