Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

I wrote my initial thesis for RPM Global in early April :

ASX:RUL (RPM Global): Navigating the Shift to Recurring Revenue under Visionary Leadership

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in stocks mentioned and hence probably biased. This website and article i…

Here's what I noted about their valuation at that time:

RPM Global has confirmed its financial outlook for FY2024, The company expects:

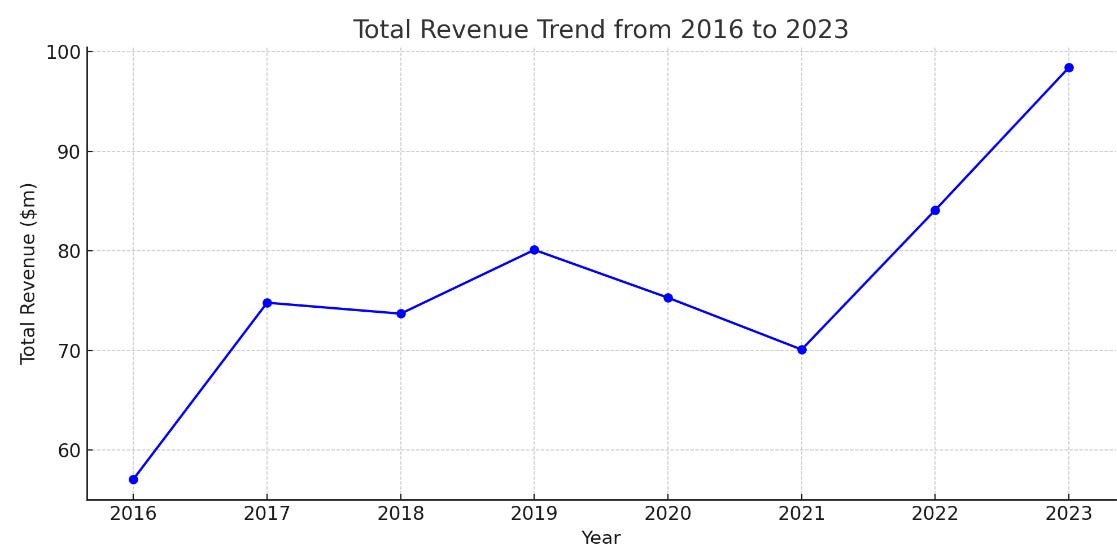

Total Revenue to range between $110 million and $115 million, a notable increase from $98.4 million in FY2023.

EBITDA to be between $21.5 million and $23.5 million, up from $12 million in the previous year.

Profit Before Tax to fall between $16.5 million and $18.0 million, compared to $4.8 million in FY2023.

Reality Check

In today's update, RPM Global provided a FY24 market update: FY24 Market Update for RPM Global

Total Gross Revenue: $113 million to $114 million.

EBITDA: $18.7 million to $19.3 million (before management incentives).

Profit Before Tax: $14 million to $14.5 million (before management incentives).

The company also expects management incentives to be between $3.5 million and $3.9 million. Deducting these incentives, the Profit Before Tax comes down to $10.1 million to $10.6 million.

At the time of writing, the market has reduced RPM Global's market cap by 20%, bringing the share price to $2.25 and the overall market capitalization to roughly $500 million.

The reason for the guidance miss is given as below :

The lower-than-forecasted profitability is due to reduced perpetual license sales and the timing of subscription licenses signed during the second half of FY2024

My initial thesis isn’t broken by today’s update.

However, the management’s ability to forecast is definitely in question here. I believe this has happened before. It might be better if the management refrains from providing guidance in the future to avoid these self-inflicted setbacks.

I believe this update will rightfully adjust market enthusiasm to a more realistic level.

Thank you for your insight.