PEXA's (ASX: PXA) Strategic Position and Expansion

Will PEXA Maintain Its Market Dominance and Successfully Expand Internationally?

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

E-Conveyancing Market in Australia

Within Australia, property transactions have been transitioned from traditional paper-based processes to a digital environment (e-conveyancing); hence, it’s efficient and transparent for all parties involved.

E-conveyancing allows parties involved in property transactions to:

Prepare and lodge property titles electronically.

Transmit settlement funds.

Pay relevant taxes and duties online.

The total addressable market for e-conveyancing in Australia is estimated to be around $300 million.

Key states like New South Wales, Victoria, South Australia, and Western Australia have mandated e-conveyancing for all property transactions, while Queensland has done so for some transactions. The Australian Capital Territory (ACT), Tasmania, and the Northern Territory have not yet mandated e-conveyancing.

Principal Players in the Market

PEXA (Property Exchange Australia)

Founded in 2011 by state governments and private investors.

Operates in the ACT, New South Wales, Queensland, South Australia, Victoria, and Western Australia.

Handles 99% of all digital property transactions in key states.

Considered a market leader and holds a near-monopoly status.

Sympli

Created by the Australian Securities Exchange and InfoTrack in 2018.

Established to provide competition to PEXA.

Holds less than 1% market share in New South Wales and Victoria.

Concerns Regarding Market Concentration

PEXA's dominance has raised concerns about market concentration and lack of competition. Critics argue that the state governments' mandates effectively created a monopoly for PEXA, limiting market competition and innovation.

The Australian Competition and Consumer Commission (ACCC) has highlighted these concerns, emphasizing the need for a competitive market structure to foster innovation and efficiency.

Interoperability Challenges

Interoperability, the ability for different e-conveyancing networks (like PEXA and Sympli) to work together and exchange information, is a critical issue in the market. Currently, all parties must use the same network, either PEXA or Sympli, to complete a transaction. This lack of interoperability creates significant barriers for new entrants and reinforces PEXA's dominant position.

PEXA’s Perspective:

Interoperability was not considered during PEXA’s foundation.

Significant changes to the design and architecture of their network would be necessary.

Concerns about potential risks to reliability, security, and resilience.

Sympli’s Perspective:

The lack of interoperability hinders competition.

PEXA's dominant market position creates barriers for new entrants.

Sympli advocates for regulatory changes to enforce interoperability.

Progress Towards Interoperability

The Australian Registrars’ National Electronic Conveyancing Council (ARNECC) is leading efforts to establish interoperability, aiming for full functionality by the end of 2025.

June 11, 2024 Ministerial Forum:

Ministers acknowledged ARNECC’s considerable efforts and contributions from ELNOs (Electronic Lodgment Network Operators) and industry stakeholders.

Emphasized the benefits of competition and the need for industry and consumer confidence.

Noted issues raised by the banking industry regarding the Interoperability Program, some of which are beyond the remit of States and Territories.

Agreed to raise these issues with the Commonwealth Government and regulators, acknowledging significant challenges without resolving these issues.

June 26, 2024 ASX Announcement from PEXA:

PEXA acknowledged ARNECC’s statement pausing the interoperability program and standing down the project team.

Reiterated its commitment to working constructively with regulators and industry participants to support an ecosystem that benefits Australian home and property owners.

There are various AFR articles that you can read about PEXA here: https://www.afr.com/company/asx/pxa

PEXA’s Principal Activities

As earlier described, PEXA’s principal activity is to provide digital platform in Australia market for Properties settlement i.e PEXA Exchange, Pexa operates two other divisions - Digital growth and International:

PEXA Exchange:

Supports about 90% of property transactions in Australia.

Provides a secure online workspace for property transactions.

Facilitates financial settlements through electronic funds transfer.

Manages financial disbursements and payment of stamp duties.

Lodges various dealings with Land Title Offices.

Digital Growth:

Provides property-related analytics and digital solutions.

Serves financial institutions, governments, property developers, and professionals.

Acquired companies like .id and Value Australia to enhance services.

Invests in firms that offer complementary solutions like Landchecker Holdings.

International:

Entered the UK market focusing on England and Wales.

Established PEXAGo for lodgement and PEXAPay for settlement systems.

Partnered with Hinckley & Rugby Building Society and Shawbrook Bank.

Acquired leading UK mortgage processing firms such as Optima Legal and Smoove.

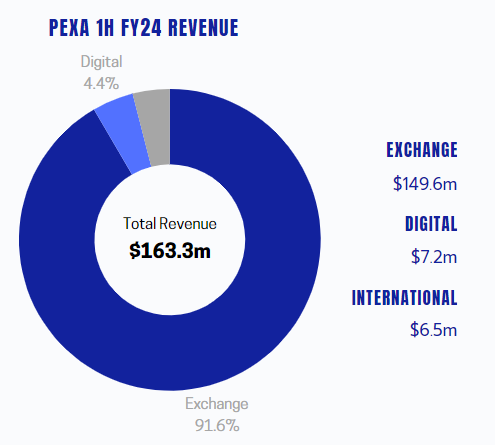

PEXA’s financials underscore its dominant position in the e-conveyancing market. In the first half of FY24, PEXA generated a total revenue of $163.3 million, with the PEXA Exchange division accounting for $149.6 million (91.6%), the Digital Growth division contributing $7.2 million (4.4%), and the International division adding $6.5 million (4%).

This breakdown highlights that PEXA Exchange is the core revenue driver, making up over 90% of the company’s income. PEXA Exchange is highly profitable and cash-generating, benefiting from its near-monopoly status in Australia.

PEXA is currently leveraging the profit generated from its Exchange division to invest in its Digital Growth and International expansion efforts. For investors to evaluate PEXA’s potential as an investment, three critical questions need to be addressed:

Will PEXA Exchange continue to be a monopoly and a money-generating machine?

PEXA’s near-monopoly status in the Australian e-conveyancing market provides it with a strong, stable revenue stream. However, regulatory changes aimed at fostering competition and achieving interoperability could impact this dominance. Monitoring regulatory developments and PEXA’s responses will be crucial.

Will PEXA’s International expansion be successful and start generating money?

PEXA’s strategic initiatives in the UK market, including partnerships with NatWest and acquisitions of Optima Legal and Smoove, are promising steps towards international growth. The success of these efforts in generating significant revenue will depend on how effectively PEXA can replicate its Australian model in a new market and adapt to local conditions.

Will PEXA’s digital growth be successful and start generating money?

The Digital Growth division aims to provide advanced property-related analytics and solutions. Acquisitions like .id and Value Australia are strategic moves to bolster this segment. The success of this division will depend on the adoption of these digital solutions by the market and their ability to generate substantial revenue.

PEXA’s ability to navigate these factors will play a critical role in determining its future performance and value proposition in the e-conveyancing market.

PEXA is going to release its FY24 result on 21st August, I am looking forward to analyzing it further after the FY24 result.

I had not read that "Interoperability was not considered during PEXA’s foundation".

Thanks for that info.

Surprising project omission or maybe it was conveniently descoped as no interoperability is a huge advantage for PEXA combined with their first mover advantage and an IT development that works (an investment moat).

Now Pexa have downed tools on interoperability they can make it challenging to resurrect.

Pexa's partnership with National Westmister bank in the UK is significant as they are one of the main high street banks.

The UK is the main driver for growth in my opinion as so many properties.

After the UK there is Canada as they use the same underlying Torrens property title system as Australia and the UK.