Objective Corporation (ASX :OCL) FY24 Result Review

Can Objective Corp Achieve Its ARR Objectives in the Coming Years?

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

On Tursday, August 22nd, 2024, GovTech company Objective Corporation (ASX:OCL) reported its FY 2024 results. Let’s take a closer look at what these numbers tell us about their performance and what lies ahead.

Key Highlights from FY24:

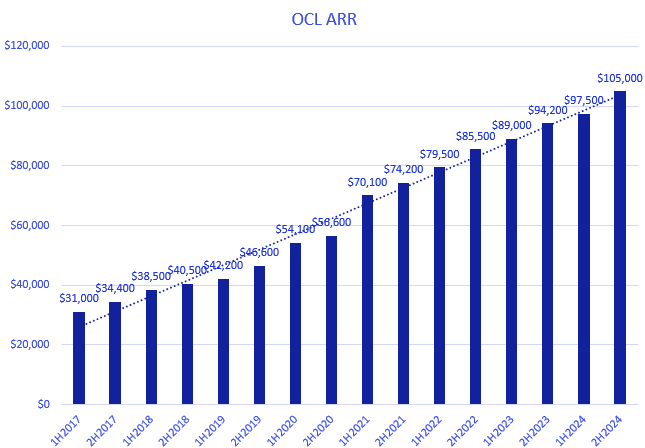

Annual Recurring Revenue (ARR) grew by 11%, reaching $105 million.

Revenue increased by 6% to $118 million.

Net Profit After Tax (NPAT) jumped 49% to $31 million.

Operating Cash Flow came in at a strong $56 million.

They ended the year with $96 million in cash and no debt on the balance sheet.

I wrote an introductory article about Objective Corp, where I discussed their thoughtful capital allocation strategy and the management's long-term mindset. The company’s leaders have significant skin in the game, truly running it with an "owner's mentality.”.

Financial Performance

Annualised Recurring Revenue (ARR)

Objective has transitioned 100% to subscription software model. The ARR has shown 18% CAGR ( FY19 to FY24) over last 5 years. However, in FY24 it fell short of targeted 15% total ARR growth and reason given was deferral of several key material oppotunity because of things out of their control and CEO said that he is confident that missed opportunity will be fulfilled in due course ( although it hasn’t been signed as yet).

This is the second year ARR growth didn’t meet 15% target. In FY23 as well, 10% ARR growth was justified by material roll-offs in the term contracts it inherited with Simflofy acquistion as well as a material deal slip in New Zealand.

Revenue

Revenue growth hasn’t kept pace with ARR. The main reason? Objective has been deliberately reducing non-recurring implementation revenue by investing in tools and processes for a more streamlined deployment framework. They’re passing these savings on to customers, which is a strategic move but does impact the top line.

Net Profit After TAX

There’s been consistent growth in NPAT over the years, with a notable jump in 1H2024. This rise was due in part to the capitalization of R&D expenses, as advised by their auditor.

How is future looking?

Generally, the ASX isn’t very forgiving when companies publish growth targets and then miss them two years in a row. But in Objective’s case, the market seems to have given them the benefit of the doubt. The CEO, who owns a significant portion of the company, appears to have retained the market's trust despite these misses.

To understand why revenue growth has been sluggish, it’s essential to break down their revenue components. As I mentioned in my earlier article, about 80% of their revenue is recurring, while 20% is non-recurring (like implementation and service revenue). Within that recurring revenue, we have both SaaS revenue and USP (Upgrade and Support Program) revenue. Over the last five years, recurring revenue has grown by 18% CAGR, but within that, USP revenue has remained relatively flat. So, most of the growth has been driven by SaaS revenue as can be seen from the picture below from presentation slide.

Non-Recurring Revenue Outlook

Screenshot from CEO’s shareholder letter for FY24

USP Revenue Outlook

USP revenue could get a boost over the next 3-4 years as Objective transitions its ECM customers to Objective Nexus. Even though it's early days with a small cohort, the indication so far is that this transition could provide a 2.1x uplift in revenue. If they manage to transition all ECM customers to Nexus in the next four years, it could significantly improve ARR and Revenue growth.

What does this means?

To sum up:

Total Revenue = SaaS Revenue + USP Revenue + Non-Recurring Revenue

Looking back over the last three years from FY22:

USP revenue has increased by only 6%.

Non-recurring revenue has declined by 33%.

SaaS revenue has grown by 40%.

If, starting from FY25, all three components of total revenue begin to move in the right direction, we could see a much better performance than in the last two years. Time will tell if Objective can hit their targets and deliver on their growth promises.