NextDC (ASX:NXT) : Not Your Average Tech Stock

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in stocks mentioned and hence probably biased. This website and article isn’t writtent to give you advise. I am just using as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t relie on it. Please conduct your own research or consult a prefessinal financial advisor - I am not the one.

NEXTDC's Value Proposition and Business Strategy Breakdown:

Value Proposition:

Focus on Customer: NEXTDC emphasizes its customer-centric approach, providing data center services, mission-critical services, and network solutions tailored to business needs.

Security and Reliability: They highlight secure, reliable, high-performance infrastructure solutions with a focus on Tier III and IV certified facilities.

National Footprint: NEXTDC boasts a network of 12 data centers across Australia, strategically positioned for cloud connectivity.

Independent Expertise: Being the only independent provider allows for flexibility and potentially faster innovation.

Expansion and Growth: Planned expansions in Australia and Malaysia demonstrate a commitment to market growth.

Advanced Technology: Investment in next-generation data centers with high power capacity, security, and energy efficiency positions them for future demands.

Industry Recognition: Awards for "Australian Data Centre Services Provider of the Year" for three years showcase their track record.

Business Strategy:

Nationwide Expansion: NEXTDC prioritizes expanding its data center network to cover major Australian markets and strategically chosen international locations.

Focus on Cutting-Edge Infrastructure: Investments in next-generation data center technology aim to maintain a competitive edge.

Building Customer Trust: Providing a 100% uptime guarantee demonstrates commitment to reliability and fosters trust with customers.

Capitalizing on Cloud Computing Growth: NEXTDC positions itself to capitalize on the growing demand for cloud services and data storage solutions.

Overall, NEXTDC's value proposition hinges on providing secure, reliable, and future-proof data center solutions through a nationwide network. Their business strategy focuses on expansion, technological innovation, and building trust with customers to capture a significant share of the growing data center market.

Market Size and Overview

Data Center Storage Market Explodes, Driven by Tech Trends

Artificial Intelligence (AI) is transforming the global economy, triggering an unprecedented surge in data generation. Consumers and businesses are projected to create twice as much data in the next five years as in the entire past decade. This explosion of data poses both opportunities and challenges for real estate investors, developers, and operators specializing in data centers. JLL's (NYSE: JLL) Data Centers 2024 Global Outlook delves into how data centers must evolve to meet these transformative shifts. Underscoring the scale of change, AI's insatiable demand for data is expected to drive data center storage capacity from 10.1 zettabytes (ZB) in 2023 to a staggering 21.0 ZB in 2027, reflecting a compound annual growth rate of 18.5%. ( According to IDC, Revelations in the Global StorageSphere, July 2023)

The global data center storage market is rapidly expanding, propelled by factors like the COVID-19 pandemic, the rise of AI and IoT, and big data analytics.

Key Statistics:

Australia's data center industry is predicted to grow at a CAGR of 7.1% between 2022 and 2028 (Arizton).

The broader Asia-Pacific data center market is forecast to reach US$53.58 billion in 2028, expanding at an impressive CAGR of 12% from 2023 (ResearchAndMarkets).

These forecasts highlight the vast potential for a company like NextDC, with its focus on advanced data centers and strategic expansion. This market growth indicates a sharp rise in demand for secure, reliable, and future-proof data storage solutions – exactly the services NextDC excels at providing.

Key Market Drivers

Cloud Migration: Businesses are increasingly shifting workloads and data to the cloud for scalability, flexibility, and cost benefits. This drives demand for data center solutions that support hybrid and cloud-based infrastructure

Artificial Intelligence (AI): The growth of AI and machine learning requires vast data storage for training and running complex models. AI-powered applications also generate significant data.

Edge Computing and 5G: Edge computing places data processing closer to the source, reducing latency. 5G connectivity empowers edge deployments.

COVID-19 Impact: The pandemic accelerated digital transformation, leading to increased reliance on remote work, cloud services, and online collaboration.

IoT and Big Data: The proliferation of connected devices (IoT) and the need to manage massive datasets are prime drivers.

A Deep Dive into NextDC's Impressive Market Growth till 2023

NextDC has been making waves in the technology sector, and its market growth numbers are a testament to its robust business model and strategic expansion. Let’s break down the key indicators that showcase this growth:

Above graphs shows each key indicator of NextDC’s market growth:

Customer Growth: Demonstrates the steady increase in customer base year over year.

Cross Connects Growth: Highlights the expansion of NextDC's data transmission network capabilities.

Operating Facilities: Shows the growth in the number of facilities operational over time.

Installed Capacity Growth: Indicates the company's growing infrastructure to support the digital economy.

Contracted Customer Utilisation: Reflects the increasing amount of capacity customers are committed to using.

Billing Customer Utilisation: Depicts the actual utilised and billed capacity, suggesting an upward trend in service use.

Each graph provides a visual representation of NextDC’s performance across different aspects of its business, underscoring the consistent upward trajectory in its operational scale and customer engagement

Total Revenue: This graph showcases a steady increase in NextDC's total revenue, peaking significantly in FY23.

Underlying EBITDA: NextDC’s EBITDA is on an upward trajectory, indicating strong profitability and operational efficiency.

Net Profit/Loss Before Tax: While there's been some fluctuation, with a notable improvement in FY22, that was because of refinance mechanism it recognized $26.5m immediately in FY22. NextDC at this stage shouldn’t be judged by its Net Profit performance in my opinion.

Share Price: The share price has seen a remarkable growth, especially from FY21 to FY23, reflecting investor confidence and a strong market performance.

Borrowing

Companies in infrastructure-heavy industries like data centers often incur substantial debt as part of their business model. Building data centers requires significant upfront capital for construction, purchasing land, acquiring technology, and outfitting facilities with the necessary equipment. These costs are typically too large to be covered by operational cash flow alone, especially when a company is expanding rapidly to capture market share or meet growing demand.

Once these facilities are operational, they can generate stable and predictable cash flows over the long term, given that clients usually enter into long-term contracts for data center services. This can make the debt more manageable as the company can forecast its future revenue streams with reasonable accuracy.

The usage of debt in such capital-intensive industries is not only common but can also be a sign of a growth-oriented strategy. As long as the company can maintain a manageable level of debt relative to its cash flow and has the assets to secure that debt, it can be a sustainable approach. Moreover, debt financing is often cheaper than equity financing as it does not dilute existing shareholders' ownership and can have tax benefits since interest payments are typically tax-deductible.

NextDC’s borrowings, which total $2.9 billion in senior debt facilities, meaning that this amount is the company’s debt structured in a way that gives its lenders priority over other debts if the company goes into liquidation.

Here's a breakdown of the facilities:

Term Loan Facility: This is a loan that the company must repay by a specific date. Two term loan facilities:

One for $800 million, which has been fully drawn, meaning the company has used all this amount.

Another for $300 million, also fully drawn and with a longer maturity date extending to December 2028.

Capital Expenditure Facility: This is a credit line specifically for funding the company's investments in physical assets, such as data centers. Of the $600 million available, $400 million remains undrawn, so the company hasn’t used this portion of the available funds yet.

Revolving Credit Facility: This is a flexible credit line that can be borrowed against multiple times and is often used for operational expenses. The company has one for $800 million, in various currencies, which is undrawn, and another for $300 million, which is also undrawn.

The facilities are set to mature mainly by 3 December 2026, which is when the company will need to have repaid the borrowed amounts or refinanced these debts. The facilities are secured by the group's assets, meaning if NextDC fails to meet its debt obligations, the lenders have a claim to the company’s assets as collateral.

NextDC has managed its exposure to interest rate volatility by entering into interest rate swaps and fixing the interest rate on $600 million until December 2024, meaning that portion of the debt will not be affected by interest rate fluctuations until then. For the remaining $800 million, NextDC has locked in the interest rate until December 2025, providing stability in financial planning.

The mention of a derivative asset and associated cash flow hedge reserve indicates that NextDC has employed financial strategies to manage the risk associated with fluctuating cash flows due to variable interest rates, recognizing this in its financial statements as of 31 December 2023.

Regarding the potential economic tailwind, if the current interest rates are at their peak and the reserve bank begins a cutting cycle (lowering the interest rates), this could indeed become a tailwind for NextDC. As interest rates decrease, the cost of borrowing can reduce for the undrawn or future debt facilities, and for any debt that is refinanced after the fixed-rate period ends, potentially reducing NextDC's interest expenses and improving profitability.

Insider holding

The insider holdings are divided into Directors and Senior Executives as follows:

Total Insider Holdings:

Directors: 0.0665%

Senior Executives: 0.1356%

The total percentage of insider holdings (Directors and Senior Executives combined) is approximately 0.2021% of the total shares issued. Although in percentage terms its not significant but The combined total value of insider holdings for both Directors and Senior Executives is $16,652,784 AUD

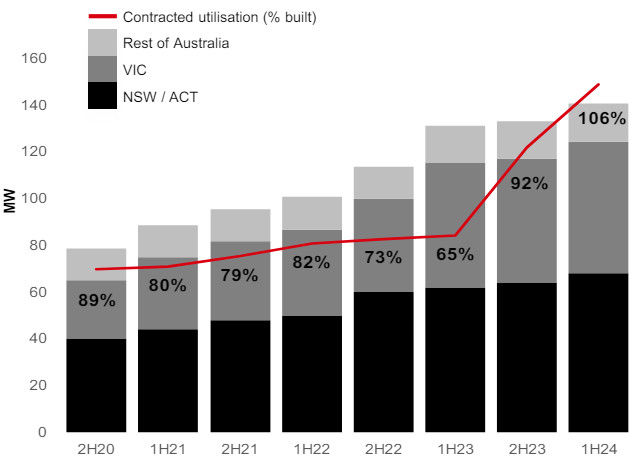

Built Capacity vs Contracted Utilisation:

This chart compares the built capacity of NextDC's data centers with the contracted utilisation rate for different time periods (2H20 to 1H24). "Built capacity" refers to the total power capacity that has been constructed and is ready for use. "Contracted utilisation" indicates the portion of this capacity that customers have agreed to use.

For instance, in 1H24, 106% of the built capacity was contracted, meaning there is more contracted utilisation than there is built capacity. This can occur due to overbooking on the assumption that not all customers will use their full contracted capacity simultaneously or due to staggered customer onboarding.

A 7.5MW increase in new built capacity was added in the 6 months to 31 December 2023, which can help meet and support the demand reflected in the contracted utilisation

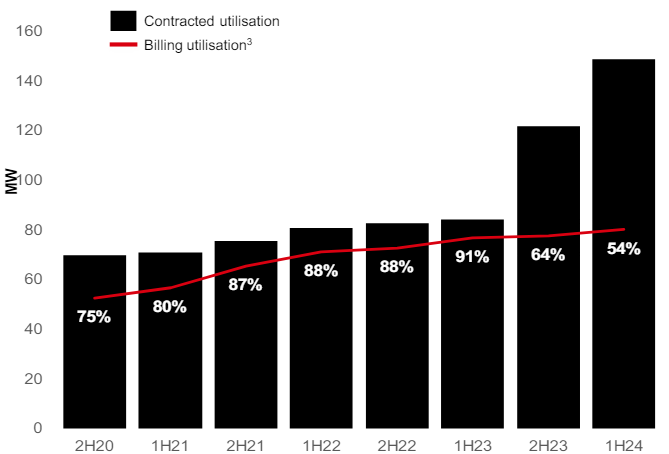

Contracted vs Billing Utilisation:

This chart contrasts the contracted utilisation with the billing utilisation. "Billing utilisation" is the actual amount of capacity that customers are using and being billed for, which is typically less than the contracted amount as not all customers will be at full capacity usage at once.

As per the chart, the contracted utilisation increased by 84.8MW (from 77% to 149.0MW) since 31 December 2022, while billing utilisation went up 3.4MW (8%) to 80.2MW during the same period. The forward order book, which is the future revenue that has been secured but not yet billed, stood at 68.8MW.

The near future revenue increase potential lies in the gap between the contracted and billing utilisation. As customers begin to utilise their contracted services, billing utilisation will rise to meet contracted utilisation levels. This means more of the capacity that customers have committed to will be used and billed, leading to increased revenue for NextDC. The fact that contracted utilisation is high (106% of built capacity) and growing suggests a robust demand for NextDC’s services, which, when it turns into actual usage (billing utilisation), will enhance the company's financial performance.

The fact that this increase in billing utilisation is based on existing contracts reduces the risk for investors since the future revenue is somewhat predictable and not solely reliant on securing new contracts. This predictable growth trajectory makes the investment into NextDC less risky in the near term, provided the company can successfully manage the transition from contracted to billed services without overextending its capacity or facing operational difficulties.

Valuation

NextDC demonstrates solid financial health and an ambitious expansion plan:

Healthy Share Base: Approximately 515 million shares currently issued.

Strong Liquidity: $590 million in cash reserves bolster growth and investment.

FY2024 Projections: Revenue targeting $400-415 million, with underlying EBITDA between $190-200 million.

Looking Ahead: FY2027 Growth Potential

If NextDC successfully converts its existing orders and contracts into active, billing customers, we could see:

Revenue Surge: Potential to reach around $800 million.

Profitability Boost: Gross profit of $370 million and net profit of $270 million.

Valuation Analysis

Standard Valuation Metric: Applying a price-to-earnings (P/E) multiple of 30x (common for similar growth trajectory companies) to the projected FY27 net earnings suggests a potential market capitalization of $11.8 billion.

Future Share Price: With modest share base growth to 547 million, this implies a future share price around $21.57.

Present Value Discount: To account for risk and time value of money, we discount the future valuation by 10%, yielding a present value of $15.73 per share for FY24.

Important Considerations:

Assumptions Matter: Small changes to revenue, profit, or share count assumptions can significantly impact valuation outcomes.

Ongoing Monitoring: It's crucial to stay updated on NextDC's performance and how market conditions evolve.

When will NextDC actually make profit? It isn't yet free cashflow positive - Will it ever reach there?