Nanosonics (ASX:NAN) FY24 Result

Pricey Bet or Hidden Gem? Who Cares—What About Those Near-Term Catalysts?

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

On Tuesday, August 27th, 2024, Infection prevention company Nanosonics (ASX:NAN) reported its FY 2024 results.

Revenue was up 2% to $170 million

NPAT reduced by 35% to $13.0m.

Free cashflow up by 3% to $20.4m

$130m in cash and cash equivalents on their balance sheet and with no debt.

I wrote an introductory article about Nanosonics, highlighting its challenges with market sentiments. Nanosonics did publish its FY24 business update to market before releasing FY24 result.

Back on July 14th, I shared my thoughts on that update and concluded:

The good news is that the second-half results are in line with or slightly better than expectations after a challenging first half.

However, the poor performance in the first half will impact the overall FY24 results compared to FY23.

Investors can be relieved that Nanosonics is not expected to miss guidance for the second half as it did in the first half. Any concerns about recent insider selling seem to have been unfounded, which is also reassuring.

Now that the full FY24 results are out, let’s dive into my thoughts on how things are progressing.

Business Operation

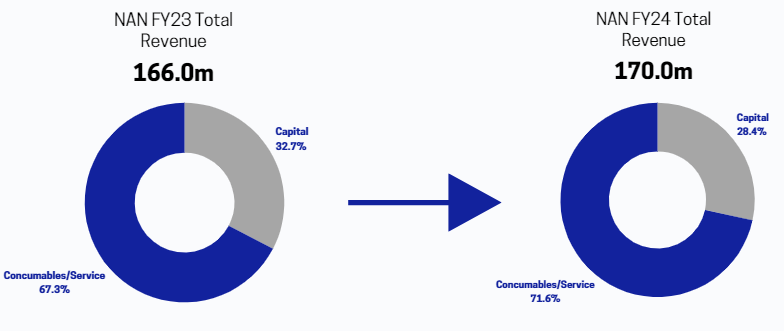

As I mentioned in my earlier post, Nanosonics generates revenue primarily from selling its Trophon2 device—either to new customers or by upgrading the older Trophon EPR devices for existing customers. However, their real bread and butter come from the high-margin consumables and service revenues tied to their growing installed base.

Looking ahead, I don’t see Nanosonics significantly increasing its new install base every year. The management’s stance for FY25 based on conference call—they expect the new installs to remain around 2,500 units. But, there is potential for growth when regions like Japan or China start contributing, which could bump that number up to 3,000 annually.

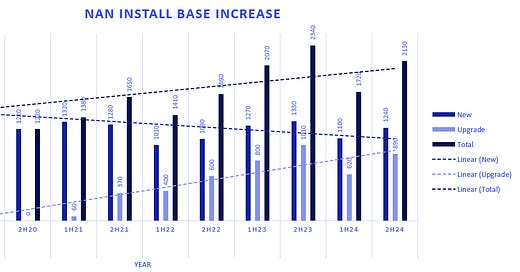

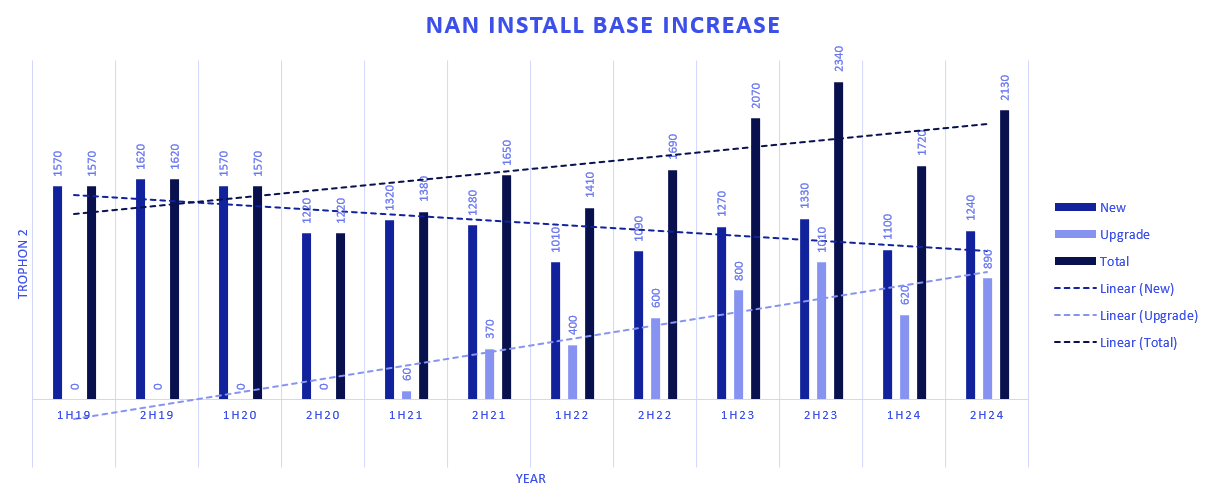

There’s also a decent opportunity for upgrades in the next few years since there are over 9,000 Trophon EPR devices that are now more than seven years old. Following graph shows half on half, incremental addition of new and upgrade units.

Going forward, I expect capital revenue (from new installs and upgrades) to stay relatively constant, the proportion of revenue from consumables and services should continue to rise. Below the differences from FY23 to FY24 (Although FY24 isn’t good example because of very weak 1H FY24)

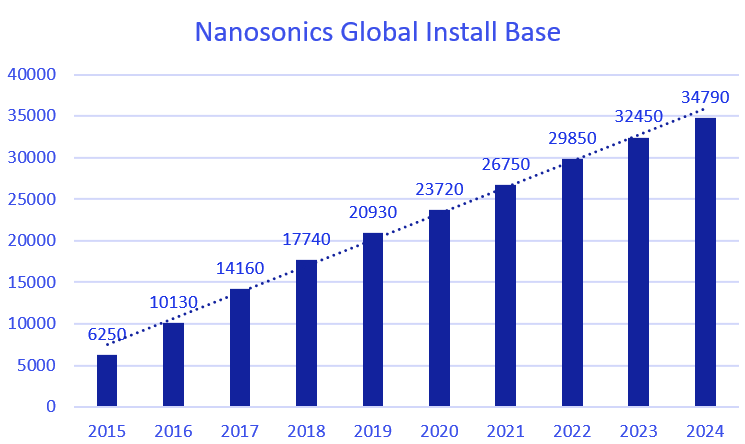

By the end of FY24, Nanosonics' total installed base grew to 34,790 units globally. It has been chugging along nicely.

Financial Performance

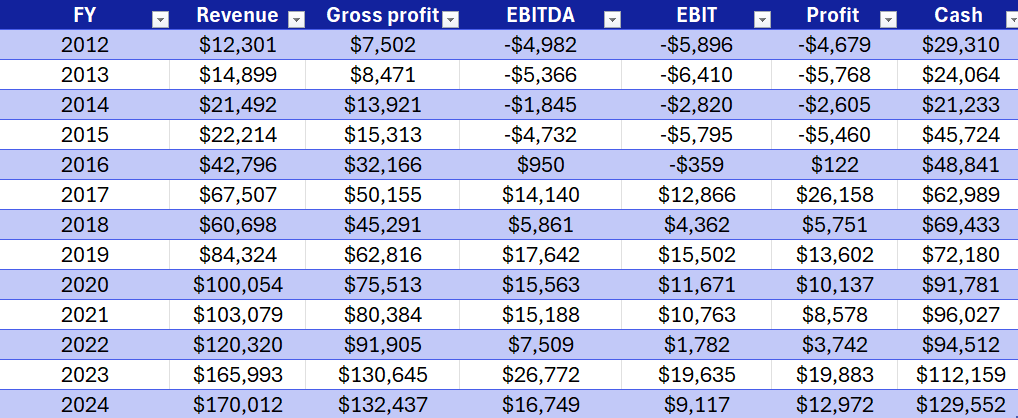

Nanosonics financial performance over the years can be summarsed in table below. Yeah, it has variable growth may be some year bit less and some year bit more but if you look at the long term record - I don’t think you can fault the performance at all.

It has increased its revenue more than 10 times in last 12 years.

What’s Going On with Service Revenue?

When Nanosonics shifted to a direct sales model in North America, transitioning all customers from GE to direct sales, they mentioned that this change would boost gross margins. What I didn't fully appreciate at the time was how significant the revenue from service would be.

Whenever Nanosonics makes a new sale or upgrade directly in North America, 50-60% of customers opt for multi-year service agreements, often paying upfront. Because the first year of service is under warranty, Nanosonics starts recognizing this revenue from the second year onwards. The upfront payments show up in the balance sheet as contract liabilities, which have been expanding since FY22—right when the sales model transition occurred. These are revenues set to be recognized in future years.

CASH Balance

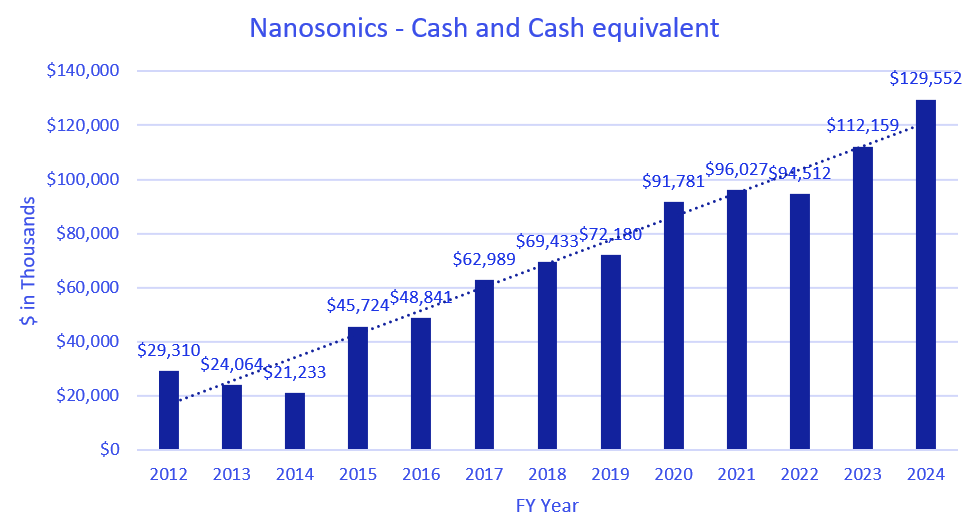

One thing Nanosonics is clearly doing right is building a solid cash balance. With no debt and around $130 million in cash and equivalents on the balance sheet, they’re in a strong financial position.

What’s Up with CORIS?

Despite building up that cash pile, Nanosonics has also been investing heavily in R&D to expand its product base. This brings us to CORIS. Not a lot of new information was shared other than that they've received some questions back from the FDA and are in the process of responding. They’re still expecting a normal 12-month timeline to get a response on their FDA de novo regulatory application, which was submitted in April 2024.

Interestingly, the annual report mentions that the CORIS system is designed to clean the full range of flexible endoscopes. But even with a De Novo clearance, it won’t cover all types right away—they’ll need further 510k applications to expand its indications fully. That likely means more investment and a longer timeline for covering the total addressable market (TAM).

Mergers and acquisitions (M & A)

Beyond Trophon and CORIS, Nanosonics has indicated an interest in expanding its product portfolio through M&A, focusing on medical device reprocessing. They even hired a dedicated resource recently to identify potential M&A opportunities. but then again, I have been hearing this since last 5 years - so I don’t really have high hopes in near future.

Competition

On the conference call, one of the analyst ask if Nanasonics have lost any opportunity in pipeline and CEO said not to any competition. Although i did notice that Germitec’s Chronos achieved FDA De Novo clearance few days ago - https://www.germitec.com/en-us/media/germitecs-fda-de-novo-classification

Now Nanosonics claims that UVC ( the technology Chronos uses) misses spot and They’ve based a whole marketing campaign around this, which you can check out here

A few years ago, Nanosonics’ CEO mentioned that their main issue was awareness. If nothing else, maybe some healthy competition could help raise broader awareness of the importance of infection prevention.

Valuation

After FY2024 result release, in which Nanosoincs also provided guidance for FY25 of revenue growth of 10% , gross margin of 78% and OPEX growth of 8% at mid point.

Nanosonics has roughly 303m shares on issue at share price of $3.50 it gives roughly 1060m market cap and an enterprise value of $931m.

Based on their FY24 profit of about $13 million, the current price-to-earnings (P/E) ratio is around 82—not cheap by any means. But if you trust management's unaudited numbers that the Trophon-only business made profit of $40 million in FY24, you’re looking at a P/E ratio of about 27. Add in the substantial cash balance and the potential upside from CORIS (if you’re a believer), and it might not seem so expensive.

Another way to look at it is this: In FY24, Nanosonics generated roughly $122 million in recurring, high-margin revenue (almost "software-like") from consumables and service contracts. If you consider this as annual recurring revenue (ARR), the company is trading at about 8 times ARR, plus its cash reserve, capital revenue, and the potential upside from CORIS.

You can make a case that Nanosonics is expensive or reasonably priced based on the assumptions you make. I’ll leave it to you to decide whether you see the value here or not.

In the near term, there could be some potential catalysts to watch: Nanosonics' 1H FY25 results will be compared to a particularly weak 1H FY24, and we might hear more updates on CORIS around that time. I'm not making any suggestions here, just offering some food for thought as you head into the weekend (assuming you're reading this before the weekend—I did publish it on a Friday, for context to ppl reading in future).