Megaport (ASX:MP1) FY24 Result and FY25 Guidance : My Reflections

Can Megaport Reverse the Decline in Net Revenue Retention?

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

Megaport (ASX:MP1) released their 2024 full-year results last week. and I wanted to build on my previous articles by sharing my thoughts on these results and what they mean for FY25. Let's dive into the details.

FY24 Results: A Closer Look at Annual Recurring Revenue

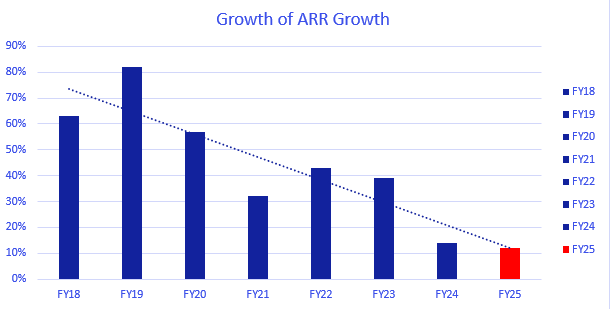

One of the key metrics for Megaport is Annual Recurring Revenue (ARR), which is calculated by multiplying the Monthly Recurring Revenue for the last month of the period by 12. At the end of FY24, Megaport reported an ARR of $203.9 million. Historically, ARR had been growing exponentially, but that trend started to shift in FY23, coinciding with significant leadership changes, including the departure of the CEO and CFO. Bevan Slattery had to step in as interim CEO before Michael Reid was appointed as the new CEO in May 2023.

Main problem is that growth of ARR growth has slowed ( if that make sense). The graph below highlights this shift, showing how the once rapid ARR growth has slowed. While it’s natural for growth rates to decelerate as a company matures, the drop in momentum is still notable. Based on Megaport’s revenue forecast for FY25, this slowdown appears likely to continue.

Revenue Growth: The Impact of VXC Repricing

ARR is a leading indicator of revenue and other financial metrics, so it's important to consider how this plays out in actual revenue growth. If you look at the revenue figures over the years, there's a noticeable anomaly between 1H2023 and 2H2023—a sharp jump in revenue. This spike was primarily driven by the repricing of Virtual Cross Connects (VXCs), which gave revenues a temporary boost. However, now that the price increase has been absorbed, revenue growth has returned to a slower pace.

During the Megaport investor call, analysts expressed concern over the FY25 guidance, which suggests limited growth acceleration. This is despite the CEO's emphasis on the turnaround efforts made in FY24, including product innovations and the rebuilding of the Go-to-Market (GTM) and marketing teams.

What’s Behind the Slowing Growth?

Let’s first understand megaport land and expand statergy,

Initally customer will land on Megaport network either by purchasing access product like port,MCR or MVE and then once customer is in the Megaport network, customer can go on to portal and add VXCs as requirement arise for new connections (i.e expand) so historically Megaport always gets 2/3rd of its growth from existing customers.

Michael Reid explained that megaport is experiencing declining NRR ( Net Revenue Retention) and the reason given are below

VXC Repricing: The recent price increases have discouraged customers from expanding their use of Megaport's network.

Market Conditions: The enterprise networking market is generally slow, with many peers also experiencing declining NRR.

Innovation Stagnation: Megaport stopped innovating 2-3 years ago, leading to fewer new customer acquisitions. New customers typically expand faster than established ones.

To fix above, Megaport has gone through pricing changes again in end of Q3FY24 and start of Q4FY24 - My hypothesis is that this price changes is the reason for reduced guidance Along with this pricing change, investment made in product innovation, marketing team rebuild, GTM team rebuild will help reverse the declining NRR.

Customer Retention: A Closer Look at the Cohort Survivorship

Megaport doesn’t publish churn details as one of the metrics but on the conference call, CEO mentioned churn is constant and Megaport doesn’t have churn issue. However, Megaport does provide Customer Cohort survivorship chart as can be seen below.

This chart needs to read in the direction of the arrow I have pointed. so the way I understand, All of the new customers who signed up in FY24, 83% of them survived by end of FY24, All the new customers who signed up in FY23, 81% of them were still there at the start of FY24 but at the end of FY24 65% survived and so on.

From this chart it is difficult to reconcile that churn isn’t affecting Megaport at this stage but on the conference call it was pointed out that this chart doesn’t reflect revenue generating customers ( new metric they have pivoted in FY23) and it reflects customer based on accounts which could be misleading.

Shifting to Higher-Value Contracts

One notable shift is Megaport's pivot to solution selling, which involves targeting higher-value contracts. This is reflected in the new metric shared in the FY24 results: a 20% growth in customers generating more than $100K in ARR. However, as Megaport chases these higher-value contracts, it's possible that some new customers onboarded in FY25 might not immediately contribute to revenue, which could explain the conservative revenue growth forecast.

For example, promotion like below will add customers but won’t add revenue immediately.

Valuation and Looking Ahead

When I first wrote introductory article about Megaport, I anticipated more robust growth in FY25, especially given the investments made in rebuilding the GTM team during FY24. However, I'll have to adjust my expectations, not just for FY25 but for the future. It will be crucial to see if the issues with NRR are resolved through new pricing strategies and whether growth momentum picks up. I'll be watching the 1H FY25 results closely to see how these metrics evolve.

To sum up, if you can answer this one crucial question, you’ll be able to accurately assess Megaport's value:

Can Megaport successfully Reverse the Decline in Net Revenue Retention?

Market thinks Megaport can't reverse NRR decline