Is Objective Corporation (ASX:OCL) a Good Long-Term Investment?

Exploring the Value and Strategic Vision Behind Objective Corp’s Success

Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

In one of my recent tweets, I listed the formula for outsized return as shown below:

If I were to rewrite this, I would change the highlighted line to:

"Buy at a reasonable price and invest in it for the long term."

This led me to take a deeper dive into Objective Corporation (OCL) - which seems to satisfy all the bullet points listed in a tweet.

Let’s GO

Background

Objective Corporation provides software for government and regulated industries. Founded in 1987, it went public on the ASX in August 2000. Since then, it has been profitable and consistently growing its revenue.

Objective's customers include local, state, federal, and central governments, defense and regulatory bodies, and enterprises with high regulatory requirements like finance, insurance, wealth management, sovereign funds, super funds, utilities, social care, universities, and law enforcement.

Over the years, Objective has built a portfolio of products through both organic growth and acquisitions. These products are categorized into three segments:

Content & Process: Information governance and management solutions.

Planning & Building: Tools for planning and building teams to assess, compare, annotate, and approve digital plans.

RegTech: Designed for customers to make informed and quick decisions for licensing, compliance, and enforcement.

Objective has offices in Australia (HQ in Sydney), New Zealand, Europe, North America, and Singapore, serving over 1,000 customers worldwide.

Leadership and Board

Objective's board is unique. Tony Walls, the CEO and Chairman, founded the company in 1987 and holds a substantial 64% stake (about 62 million shares. Its unique in the sense that the single person is the founder, CEO, and Board Chairman.

You could say that he has around $800 million of his wealth invested in Objective, so there's no doubt that the CEO (and Chairman) is fully aligned with the shareholders. However, this also represents the biggest key man risk to Objective Corp.

If you want to get an insight into his thinking, listen to this interview.

Gary Fisher, Ex Non-Executive Director (NED) for 34 years, became an NED in 2007.

He resigned from NED in August 2023. He holds about 5.3% of the company (5.1 million shares) and has been selling his shares consistently over the years, including a notable sale of 20 million shares at $0.21 in 2011 and 12.5m shares at $0.45 in 2013

Stephen Bool joined the Board as NED in Jan 2022. He worked with Objective for 17 years in senior leadership positions and most recently as COO for 5 years.

Darc Rasmussen ( Ex-CEO of Integrated Research) and NIC Kingsbury are other NEDs.

Together, board members hold around 70% of the total shares.

Financial Performance

Balance Sheet

Objective has a clean and strong balance sheet

At the end of the First Half of 2024, It has

$67m Cash

$0 in Debt

Annualised Recurring Revenue (ARR)

Objective has transitioned from offering on-premises perpetual licenses to a subscription software model. The ARR has shown significant growth over the years, with the Content Solutions segment contributing 73% of the ARR.

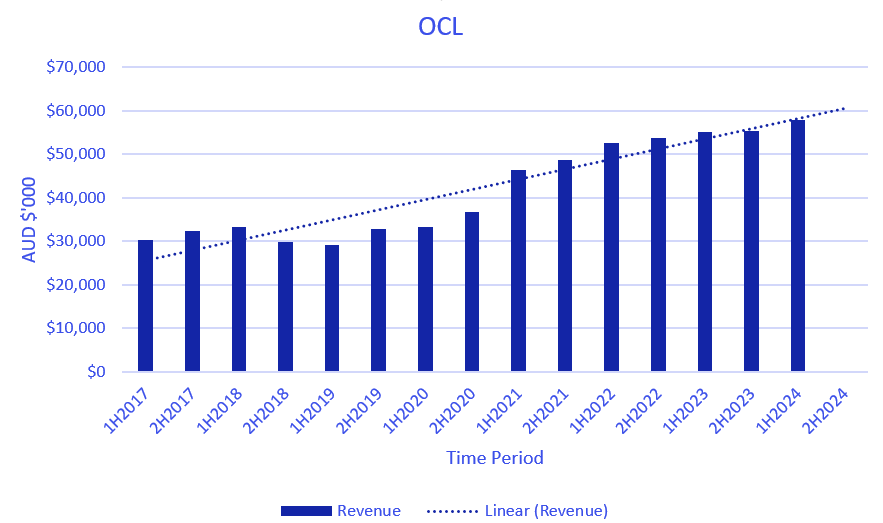

Revenue

ARR is the leading indicator of Revenue. the following graph shows the growth of Objective’s revenue in recent years. It has converted all its perpetual software sales into a recurring subscription software model.

As of 1H2024, 100% of software is sold in a subscription sales model. However, Objective still has some non-recurring revenue with includes implementation or consulting services to customers - this implementation and consulting service revenue is low margin revenue and as of 1H2024 it counts for 20%

The CEO mentioned that they are investing in process excellence and repeatable deployment models to deliver solutions faster and cheaper, which should lower service revenue per deployment but benefit them in the long run by onboarding more customers quickly.

Net Profit After TAX

The NPAT has grown over the years. The sudden rise in 1H2024 is due to the capitalization of R&D expenses, as advised by their auditor.

Share Count and Buyback History

We looked at the Increasing Revenue, Increasing Profit now let’s look at the Share count.

Objective has a history of buying back shares at attractive prices. For example:

During the 2008 financial crisis, they bought back 15 million shares. - ASX Announcement Link

In 2011, they bought 20 million shares at $0.21 when Gary Fisher wanted to sell. - ASX Announcement Link

In 2013, they bought 12.5 million shares at $0.45 from Gary Fisher. - ASX Announcement Link

From 2018 to 2020, they had a buyback program running, buying shares anytime they went below $5. - Announcement Link

During the exuberant market of 2021 and 2022, they bought no shares.

In 2023 -2024, they had an on-market buyback program, buying shares whenever the price went below $12. This program expired recently.

A new one starts on July 5, 2024 - Announcement Link. I hypothesize that from July 5, any shares sold under $12 will likely be purchased by the company's buyback program

Shares on Issue = ~96m

Share Price = $12

Market Cap = $1.15 billion

ARR ( at 1H 2024) = $97 million

Cash = $67 million

Revenue ( doubling 1H 24) = $116 million

I'll leave it to you to decide if $12 per share, which equates to a $1.15 billion market cap, is good value for this business. Management certainly believes it is, and their judgment has been spot-on so far. However, this time could be different.

Thank you for reading, and keep looking for multi-year compounders!