Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

Back in early August 2024, I shared my thoughts on Audinate’s FY24 results ( you can read it here) highlighting my expectations ahead of its release ( obviously it didn’t meet my expectation as well as market’s expectation). Fast forward to six months, and the company has faced significant challenges, with another downgrades in a short span—first with its disappointing guidance for FY25 during FY24 result presentation and then again with further downgrade in their 1Q FY25 trading update. Management has already set expectations that FY25 will be a transition year, which raises several key questions in my mind.

What headwind Audinate is facing? - is it structural issue or something that company doesn’t have control over.

Is Audinate cyclical business or is it once off? Is these headwind near end?

Is Audinate operationally performing based on outside view?

What headwind Audinate is facing?

Audinate’s recent performance has been impacted by industry-wide and company specific headwinds.

Industry-wide headwinds

Customers Investory Levels (H1) : Many of Audinate’s manufacturing customers had previously over-ordered chips and modules, leading to an inventory buildup. This has resulted in a slowdown in new purchases while customers clear existing stock

Shorter Lead Times (H2) : Once the Chip supply has normalised, in FY24 Audinate managed to clear the backlog and hence overachived revenue. There are no backlogs to clear in FY25.

Softer End-User Demand (H3): The AV industry has not yet rebounded as strongly as expected.

Company Specific headwinds

Transition to Software (H4) : The shift towards software-based Dante implementations continues, driving margin expansion but at the cost of lower per-unit revenue.

End of Life Products (H5): Legacy products like Viper being phased out, creating addition revenue headwinds.

Is Audinate a Cyclical Business or is This a One-Off Issue?

When I look at all five headwinds (H1 to H5) outlined earlier, I see a mix of factors that contribute to Audinate’s current situation.

Audinate’s business model inherently involves some level of reliance on manufacturer and OEM inventory levels, as well as lead times. Any disruption in the supply chain will have an impact, though with a delayed effect. However, as Audinate transitions to software-based Dante implementations, this reliance should diminish. Additionally, this current situation is largely a result of once-in-a-century events like COVID and the supply chain disruptions that followed. Given this, I lean towards the view that H1 and H2 have played a larger role in this downturn, and hopefully, this is a one-off event rather than a persistent issue. In the future, Audinate should be able to navigate smaller supply chain disruptions more effectively.

H3—softer end-user demand—is a factor that will always remain, affecting most companies. While Audinate is somewhat reliant on the broader economy and consumer/business confidence, I don’t see it as overly dependent. The company operates on a global scale and is expanding from audio-only offerings to video and management products, providing some insulation from economic cycles.

H4 and H5—product transitions and end-of-life products—are genuinely once-off issues. Over the long run, these changes should be operationally beneficial for Audinate. While H4 (the shift toward software) will take a few years to fully play out, its impact should decrease over time as the transition progresses.

Overall, I believe Audinate is not entirely a cyclical business, but it is also not completely immune to broader economic trends. That said, I am comfortable assuming that this is not a structural issue at this stage. As I’ve been tracking the broader Audio-Visual (AV) industry, I have been looking at leading indicators to assess whether growth is picking up. Unfortunately, the signals remain weak. For instance, the AVIXA Sales Index suggests that sales growth has slowed, and similar trends can be observed in the financial results of key industry players like Yamaha and Aver. These indicators reinforce the idea that a strong recovery in AV product demand has yet to materialize.

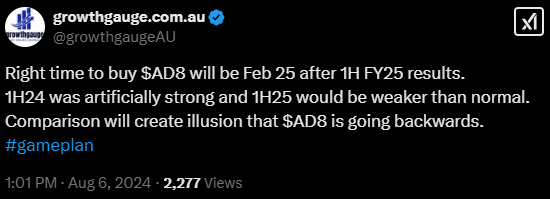

Given this context, I believe Audinate’s first-half FY25 results will likely disappoint, particularly when compared to the exceptionally strong first-half FY24 numbers. More importantly, even if the company does manage to meet expectations, I do not see a scenario where it provides a confident, growth-driven outlook for the second half. The recovery appears to be a drawn-out process rather than an immediate turnaround.

Is Audinate Operationally Performing Based on External Observations?

What I mean by this question is whether management is executing on their stated strategy and making long-term decisions that align with their vision.

There are several reasons to believe that Audinate is performing well operationally:

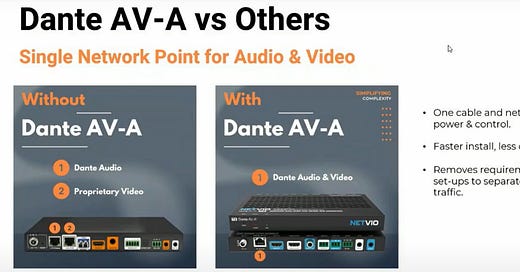

Audinate continues to innovate in the AV field, launching products that address real industry challenges. Examples include Dante Director, Dante Connect, and the Dante-AV protocol.

Audinate focus is in onboarding as many manufacturer and OEM partner and increase products with them and build the network as much and as fast as it can and rest will take care. Even in 1Q2025 trading update they indicated that design wins increased by 22%.

Audinate has already established itself as the de facto standard in professional audio and is making strong progress in video. Several factors give Audinate an advantage in the video market:

AV professionals who have been trained on Dante certification require no additional learning to adopt Dante-AV, as the same principles apply.

Audinate has over six million audio devices deployed in the field, with no true alternative offering an ecosystem as expansive as Dante. It makes logical sense for customers to extend this to video devices within the same network.

Selecting an alternative standard for video would be costly for manufacturers, system integrators, and end users. One manufacturer cited the following reason for choosing Dante-AV:

Historically, a drawback of Dante compared to other software-based protocols was its requirement for dedicated hardware. However, with Audinate transitioning to software-based implementations, this limitation is being eliminated.

These factors suggest that despite near-term financial headwinds, Audinate is making the right strategic moves to strengthen its position in the AV industry for the long term.

My Strategy

Considering these challenges, my base case is that Audinate’s share price will decline after its first-half FY25 results. The following tweet succinctly outlines my strategy.

Another interesting factor to consider is the short interest in Audinate. Currently, about 7.5% of the company’s shares (approximately 6.2 million shares) are being shorted. This means that, at some point, these positions will need to be covered, which could drive some buying activity.

Looking at historical liquidity, when Audinate issued its first downgrade on August 6, 2024, the total volume of shares exchanged on that day was roughly 5.6 million. This suggests that if another sell-off occurs post-results, it may create a buying opportunity, especially if the market overreacts to short-term weakness.

The Risk of Confirmation Bias

While I hold a bearish near-term view, I acknowledge the risk of confirmation bias. Am I simply looking for data points that align with my existing belief that Audinate’s stock will decline ( as you can see that was my view in last year August as well). Could I be missing signs that the company is already on the path to recovery?

The alternative scenario is that Audinate surprises on the upside. Perhaps the company has managed to navigate its inventory challenges more effectively than expected, or maybe there are new revenue drivers that haven’t been fully appreciated by the market yet. If Audinate “comes out all guns blazing,” as the saying goes, the stock could see a sharp rebound, proving my cautious stance to be overly pessimistic.

Final Thoughts

Audinate remains a high-quality company in a strong strategic position, but short-term turbulence is undeniable. The upcoming first-half FY25 results will be a crucial moment, not just in terms of financial performance but also in setting expectations for the rest of the year.

For now, I remain cautious, anticipating near-term weakness but keeping an open mind. I am just documenting this for my referencing and there is a high chance that I could be wrong (and that wouldn’t be the first time either). So, you are welcome to read it and interpret it as you see fit. I am just thinking out loud—it is safe to ignore me.

Let’s see how this unfolds. Happy Valentine’s Day—and, more importantly, happy earnings season!

ripper , ta :)