Disclaimer: The information contained within this website and article is not financial advice and reflects my opinion in a strictly personal capacity. I am an engineer by training and profession; I do not possess formal qualifications in finance or investment. I may hold positions in the stocks mentioned and hence probably biased. This website and article aren’t written to give you advice. I am just using it as my online journal to share knowledge and insights and to get feedback - I can’t guarantee the complete accuracy of all content so don’t rely on it. Please conduct your own research or consult a professional financial advisor - I am not the one.

Lately, Audinate's share price has taken a significant hit, and there doesn't seem to be any clear reason for it (not for me atleast). While the stock has always been on the pricier side, the market might have gotten carried away with the 1H24 results, pushing the price to new highs. But what suddenly changed? Let's explore some hypotheses.

Capital Raising and CEO Share Sale

In September 2023, Audinate's CEO and co-founder, Aidan Williams, sold 51,702 shares at $13.66 just 10 days before the company launched a $70 million capital raising at $13 per share. This was questionable action, timing raised some eyebrows in investor community.

But after that, it successfully completed capital raise and market seemed to ignore that for time period - so I don’t think that is the case

CFO Transition

The transition of the CFO, announced in May 2024, appears to have contributed to the recent share price weakness. Despite the CFO agreeing to stay through the full FY24 results to ensure a smooth handover, the market has reacted negatively, possibly due to concerns about leadership stability and continuity.

However, there doesn't seem to be anything particularly alarming (at least to me) in the announcement or the transition process..

Any Fundamental change?

It's possible that some fundamental change caused this market panic, and I just don’t know what has happened. Potential reasons for the decline could include:

Significant changes impacting its future growth potential.

Emergence of strong competition or superior technology.

Concerns about regulatory actions to curb its market dominance.

Loss of a major customer or supporter, such as Yamaha, to a competitor.

I couldn't find any substantial issues related to technology, competition, or regulation during my research.

Mr. Market not happy?

This might just be typical market behavior. Companies with momentum and significant share price increases in a short period, especially those with high multiples, can face such fluctuations. It's nearly impossible to value such (or any) companies with pinpoint accuracy.

So what now?

With the full-year results set to be released on August 19th, this results could significantly impact the share price. Therefore, it's time for me to revisit and write my view and expectation of the company and how to interpret the upcoming results. This post aims to prepare myself to quickly analyze and comprehend the results as soon as they are released.

What does Audinate Do?

Audinate is an Australian company that specializes in digital audio and video networking solutions. Their flagship protocol, Dante, is a proprietary audio over IP (AoIP) networking technology protocol that allows for seamless and reliable transmission of digital audio signals over standard IP networks.

Their relatively new Dante AV is proprietary video over IP networking protocol.

Audio protocol has become a standard in the professional AV industry due to its ease of use, scalability, and high-quality performance. Dante-AV is relatively newly released protocol and number of video products are increasing however, it is still hasn’t become a standard and there is a potential it may not be the clear winner.

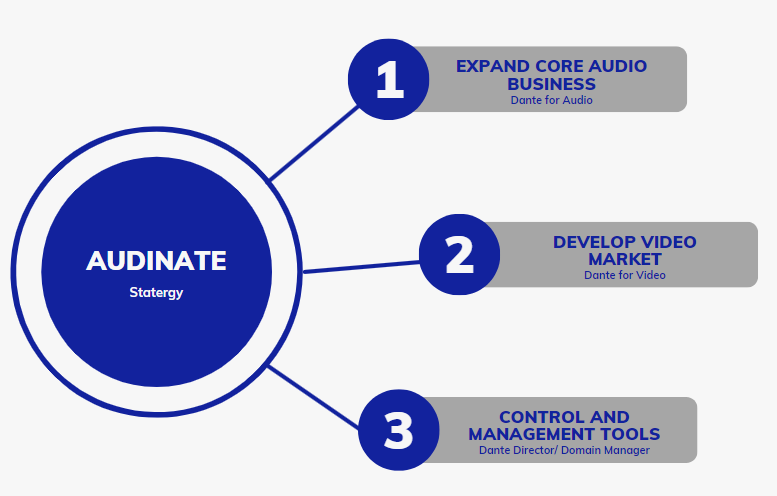

Audinate also developing its control and management software offering along with interconnecting audio and video devices.

Audinate statergy stands on three legs as seen in the picture below:

Understanding Dante

Dante stands for "Digital Audio Network Through Ethernet." It essentially replaces traditional analog audio cables with Ethernet cables, enabling audio signals to be sent over long distances without degradation.

Up until very recently, Dante’s main job was to replace Audio cables with networking cables by placing their hardware into OEM’s devices. Few year ago Audinate also developed software which replaces their hardware module so OEM doesn’t need their module in their product but it can be activated after purchase as a license ( for example : https://www.qsys.com/products-solutions/q-sys/scaling-feature-licenses/software-based-dante/ )

Audinate also has developed a technology to transmitt audio traffic over WAN i.e. traffic over different network (Dante Connect) that makes it possible to have all backend infrastructure hosted in cloud or somewhere else centrally. ( For example, you can have dante enabled microphone, speaker and video camera on 3-4 sites, send that audio and video traffic using dante protocol over IP network to Google Cloud where those video and audio can be mixed/edited and final output can be broadcasted to somewhere else over IP Network). That means you don’t need high end mixers/DSPs etc onsite as well as cloud-based editing means engineers can do their jobs from wherever they are. ( https://www.getdante.com/products/network-management/dante-connect/)

This makes it ideal for large-scale audio installations such as

Broadcast studios / Live event venue

Universities and educational institutions

Corporate campuses and conference rooms

Broadcast studios and recording facilities

Houses of worship

Arenas, stadiums, and other large venues

Amusement parks, transportation hubs, zoos, and theatres

The versatility and reliability of Dante make it a preferred choice for AV integrators, professionals, and consumers.

Financial Performance

Audinate's 1H24 results showcased strong revenue growth, Revenue increased by 47.7% compared to 1H23. The company reported US dollar revenue of $30.4 million

Audinate has approximately 84 million shares on issue. At the current price of $14.50 per share, this gives the company a market capitalization of around $1.22 billion.

Historically, Audinate gets more revenue in 2nd Half compare to 1st Half.

Audinate increased their revenue (US$) by 40% from FY22 to FY23 ( From US$ 33.3m to US$ 46.7m), So if we keep the same 40% growth rate expectation for revenue than FY24 total revenue should be 40% higher than US$ 46.7m i.e US$ 65.38m

For 1HFY24, it has generated US$ 30.4m so to reach US$ 65.38m, it has to do US$ 35m revenue in 2HFY24 - Which i think is very much possible based on historical 1H and 2H weighting.

My Key Metrics for Upcoming FY24 Results

The upcoming FY24 full-year results will be crucial in determining whether the recent share price weakness is warranted or merely a result of market sentiment.

Revenue Growth: Continued strong performance to justify the current valuation. I expect to see more than US$ 66m of Revenue for FY24 ( i.e 40% growth over FY23)

Gross Profit Margins: Maintaining or improving gross margins will be important for long-term profitability. I expect ~72% gross margin

Product Adoption: Evidence of sustained or increased adoption of Dante technology across various industries. i.e more audio and video products as well as more professional trained on Dante

Leadership Transition: Updates on the transition following the CFO's resignation and the appointment of a new CFO.

Use of Cash Reserves: How the company plans to utilize its substantial cash reserves for growth and M&A opportunities.

Future Guidance: I expect atleast 30% growth guidance for FY25

Looking forward to dig deeper into Audinate FY24 result after 19th August. What’s your thought? - Let me know in comments below.

Good write up. I think the market might get agitated if there is not 40% plus growth over this financial year. However medium to longer term the only thing that matters is if AD8 has dominance in AV. And this is bloody hard to get a read on.

Nice writing, spot on time!